Introduction: Understanding the Bitumen Price Perspective for 2026

The bitumen price perspective for 2026 is becoming a critical topic for stakeholders across construction, infrastructure, oil refining, and government planning. Bitumen, a key petroleum-based product used primarily in road construction and waterproofing, is highly sensitive to crude oil prices, infrastructure spending, geopolitical events, and environmental regulations.

As countries accelerate infrastructure development while simultaneously transitioning toward greener energy policies, bitumen markets are entering a phase of structural change. This article provides a formal, data-driven, and forward-looking analysis of what to expect in 2026, helping decision-makers anticipate price movements and manage risks effectively.

Global Bitumen Market Overview

What Is Bitumen and Why Pricing Matters

Bitumen is a viscous byproduct of crude oil refining. Its price directly affects:

- Road construction costs

- Government infrastructure budgets

- Contractor profitability

- Long-term project feasibility

Even small price fluctuations can significantly impact large-scale projects.

Current Market Snapshot (2024–2025 Context)

While this article focuses on 2026, understanding recent trends is essential:

- Moderate recovery in construction demand post-pandemic

- Volatile crude oil prices due to geopolitical tensions

- Increasing focus on recycled asphalt and sustainability

These factors collectively shape the bitumen price perspective for 2026.

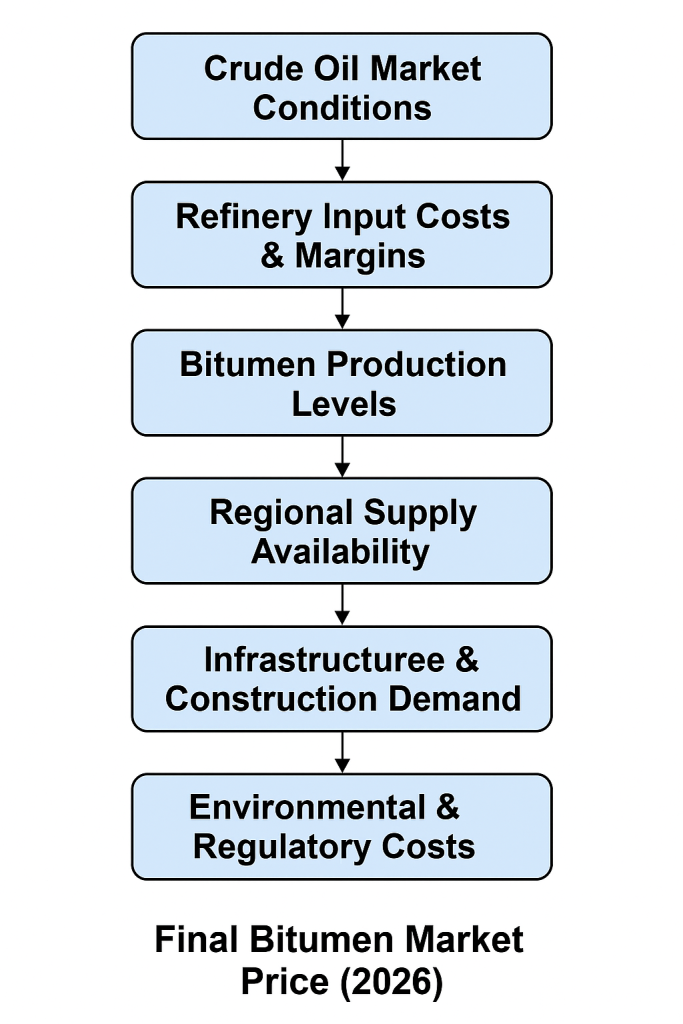

Key Drivers Influencing Bitumen Prices in 2026

1. Crude Oil Price Trends

Crude oil remains the single most influential factor in bitumen pricing.

- Higher crude prices increase refinery input costs

- Refinery margins and output decisions affect bitumen supply

Most forecasts suggest moderate crude oil stability in 2026, but with periodic volatility.

2. Infrastructure Spending and Urbanization

Governments worldwide are prioritizing:

- Highway expansion

- Smart city development

- Rural road connectivity

Emerging economies in Asia, Africa, and the Middle East are expected to drive incremental demand.

3. Refinery Capacity and Production Shifts

Refineries increasingly favor lighter fuels and petrochemicals.

- Reduced residual fuel output may constrain bitumen supply

- Maintenance shutdowns could cause regional shortages

4. Environmental Regulations

Stricter emission standards and sustainability mandates are influencing:

- Production methods

- Transportation costs

- Adoption of bio-bitumen and recycled materials

These policies may add cost premiums in certain regions.

Regional Bitumen Price Perspective for 2026

Asia-Pacific

- Strongest demand growth

- Large-scale infrastructure programs

- Prices likely to remain firm with seasonal volatility

Middle East

- Ample supply capacity

- Competitive export pricing

- Strategic role in global bitumen trade

Europe

- Moderate demand growth

- High environmental compliance costs

- Prices likely above global average

North America

- Stable demand

- High recycling rates moderating virgin bitumen demand

Table: Key Factors Affecting Bitumen Prices in 2026

| Factor | Impact Level | Price Influence |

|---|---|---|

| Crude oil price stability | High | Direct |

| Infrastructure investment | High | Demand-driven |

| Refinery production strategy | Medium | Supply-driven |

| Environmental regulations | Medium | Cost-increasing |

| Seasonal construction cycles | Low–Medium | Short-term |

Supply and Demand Balance Outlook

Demand Outlook

Global bitumen demand in 2026 is expected to grow moderately, supported by:

- Road rehabilitation projects

- Urban expansion

- Climate-resilient infrastructure initiatives

Supply Outlook

Supply growth may lag demand due to:

- Refinery optimization

- Lower residual fuel production

- Increased refinery shutdowns for upgrades

This tightening balance supports a cautiously bullish bitumen price perspective for 2026.

Risk Factors That Could Disrupt the 2026 Outlook

Geopolitical Instability

Conflicts or sanctions affecting oil-producing regions may:

- Disrupt crude supply

- Increase freight and insurance costs

Macroeconomic Slowdown

A global recession could:

- Delay infrastructure projects

- Reduce short-term bitumen demand

Technological Substitution

- Increased use of concrete roads

- Higher adoption of recycled asphalt

While not immediate threats, these trends may cap long-term price growth.

Opportunities in the 2026 Bitumen Market

Despite risks, opportunities exist:

- Long-term supply contracts to hedge price volatility

- Investment in storage to benefit from seasonal spreads

- Adoption of sustainable bitumen alternatives

Strategic planning will be essential to capitalize on favorable price movements.

FAQs: Bitumen Price Perspective for 2026

1. Will bitumen prices increase in 2026?

Prices are expected to remain firm with moderate upside risk, depending on crude oil stability and infrastructure demand.

2. How closely are bitumen prices linked to crude oil?

Bitumen prices are strongly correlated with crude oil, though local supply-demand factors also play a role.

3. Which region will drive demand growth in 2026?

Asia-Pacific is expected to lead global demand growth.

4. Can environmental regulations increase bitumen prices?

Yes, compliance costs and production adjustments may increase prices, especially in Europe.

5. Is recycled asphalt affecting bitumen demand?

Recycling moderates demand growth but does not eliminate the need for virgin bitumen.

6. How can buyers manage price risk in 2026?

Long-term contracts, diversified sourcing, and market monitoring are key risk management tools.

Conclusion: Strategic Takeaways for 2026

The bitumen price perspective for 2026 points toward a market shaped by balanced growth, constrained supply, and increasing regulatory influence. While extreme price spikes are unlikely under stable crude conditions, structural factors support a resilient pricing environment.

Stakeholders who combine market intelligence, risk management, and sustainability planning will be best positioned to navigate 2026 successfully. Early preparation and informed decision-making will turn uncertainty into opportunity.